Description

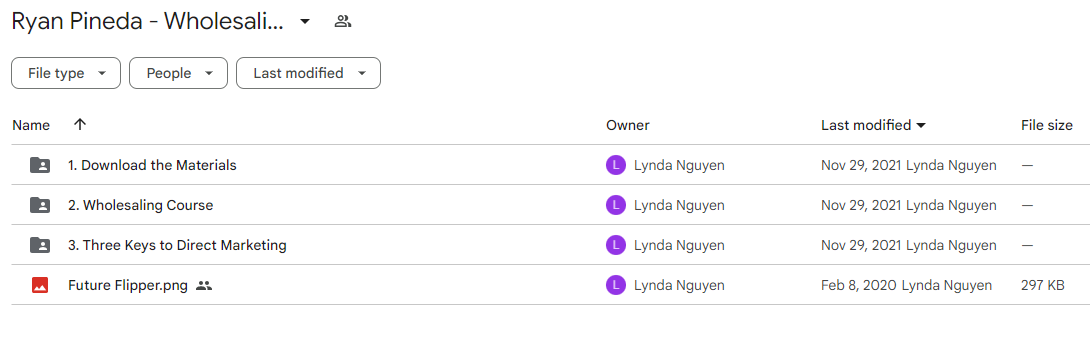

Ryan Pineda – Wholesaling Course

Patterns to Profits

My System of Profitable + Easy Trading Strategies

LEARN HOW TO TRADE STOCKS WITH THE BEST STRATEGIES AND TRADING PATTERNS

Patterns to Profits is designed to teach you some of the best strategies for day-trading, swing-trading and long-term investing, in a simple and very understandable manner, so that you can apply what you learn right away to your own trading.

You will learn the technical analysis and the charting patterns involved in each strategy while understanding how to handle, not only the good trades, but the not-so-good trades as well.

Gain the confidence to identify trading patterns with a high-success rate, manage the risk, and most importantly how to know when you should get out of the trade with your profits in hand. Go beyond just buying and selling stocks, and learn the methods that successful traders use to consistently profit in the stock market.

Here’s what other traders are saying about this course:

- “Finally a course that teaches traders real-life trading strategies that go beyond the textbook and applies it to real trading conditions. I have applied these strategies and instantly saw an improvement in my trading.” ~ Gregory Harris

- “Just want to say a big THANK YOU for this course and these videos. Learning a lot. Really appreciate your passion for stocks and investing, and your teaching style is very good. Will definitely watch more of your videos and follow your trades.” ~ Kashmud

Who is the target audience?

- Beginner and Intermediate Traders

Class Curriculum

Head & Shoulders + Inverse Head & Shoulders Pattern

- Trading H&S + IH&S Patterns (1:15)

- Intel Corp (INTC) Head and Shoulders Pattern (5:14)

- Starbucks (SBUX) Inverse Head and Shoulders Pattern Daily + Weekly (5:03)

- Apple (AAPL) Head and Shoulders Pattern (2:08)

- Broadcom Limited (AVGO) Inverse Head and Shoulders Pattern (2:42)

- Univar (UNVR) Inverse Head and Shoulders Pattern Intraday (4:37)

- KB Home (KBH) Inverse Head and Shoulders Pattern Monthly Chart (2:48)

Playing the Trend Line Bounce

- Trading Rising and Declining Trend Lines (1:31)

- Bank of America (BAC) Rising Trend Line (6:13)

- Royal Caribbean Cruises (RCL) Declining Trend Line (9:09)

- Tesla (TSLA) Rising Trend Line (9:12)

- Tractor Supply (TSCO) Declining Trend Line (5:36)

- Alibaba (BABA) Rising Trend Line (5:56)

- Apple (AAPL) Declining Trend-Line Weekly Chart (8:05)

Trading The Flag Pattern

- Simplicity of the Flag Pattern (1:02)

- Amazon (AMZN) Bull Flag Pattern (5:51)

- Aecom (ACM) Bear Flag Pattern (5:20)

- Norfolk Southern (NSC) Bull Flag Pattern (6:24)

- Verizon (VZ) Bear Flag Pattern (4:49)

- Norwegian Cruise Line (NCLH) Bull Flag Pattern (3:37)

- Nike (NKE) Bearish Flag Pattern (5:12)

How to Trade Using Support and Resistance Levels

- Support/Resistance Breaks and How to Use them (0:50)

- Harris Corp (HRS) Support Breakdown (7:14)

- Chipotle Mexican Grill (CMG) Resistance Breakout (4:30)

- D.R. Horton (DHI) Support Breakdown (6:19)

- Citrix Systems (CTXS) Resistance Breakout (6:03)

- Square (SQ) Support Breakdown (3:58)

- Facebook (FB) Resistance Breakout (2:43)

Understanding and Profiting from Triangles

- Triangle Play and How It Works for You (0:49)

- F5 Networks (FFIV) Ascending Triangle Break Up (3:50)

- Perrigo (PRGO) Descending Triangle Breakdown (5:09)

- J.P. Morgan Chase (JPM) Symmetrical Triangle Break Up (4:44)

- Alphabet (GOOGL) Symmetrical Triangle Breakdown (3:37)

- Adobe Systems (ADBE) Continuation Triangle (4:13)

- Cimarex Energy (XEC) Continuation Triangle Pattern (4:47)

Wrap-Up

- Final Words (1:08)

10 reviews for Ryan Pineda – Wholesaling Course

There are no reviews yet.