Description

Dakota Wixom – Become a Quantitative Analyst

What is this Course About?

Wall Street needs more quants and data scientists.

This course will allow you to build the essential initial programming skills and tool belt of statistical techniques required for quantitative analysis.

First, we’ll teach you how to program with financial timeseries before diving deep into multivariate regressions using factor analysis to explain Berkshire Hathaway’s performance.

Next, we’ll examine the performance of 9 different hedge fund strategies and compare the risk and return characteristics of each type of fund.

Finally, we’ll construct our own fund strategy using quadratic optimization to track a benchmark on a rolling basis, and we’ll build our own backtesting engine in R to analyze our strategy.

Am I Ready for this Course?

Whether you’re a hedge fund manager or a business student, this course is for you if you’re looking to upgrade your game and begin investing intelligently.

We’ll provide you with commented source code, guided video tutorials and high quality animations to help you understand every line of code and concept.

Become a Quant.

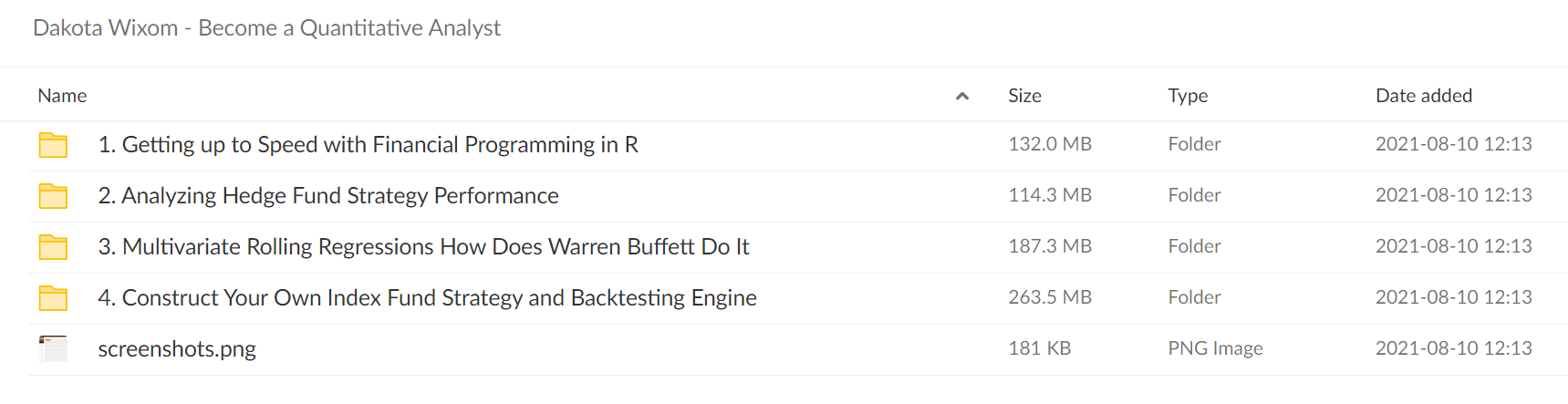

Course Curriculum

Getting up to Speed with Financial Programming in R

- Getting ed With R

- R Financial Programming Bootcamp (1:05:29)

- Hedge Fund Strategy Indices | Downloading Data From Quandl (12:11)

- Beating the Market or Not | Analyzing Hedge Fund Performance (20:48)

- Market Factors | Setting Up the Multivariate Rolling Regression (25:30)

- Warren Buffett vs. The Fama-French Factor Model (19:23)

- Analyzing Warren Buffett’s Sector Exposure (11:01)

- FREE: Example Custom Index Strategy Reports

- Picking a Benchmark | Dynamically Downloading the Datasets (16:43)

- Quadratic Optimization | Building a Rolling Backtesting Engine (24:37)

- Visualizing the Results | Tracking New Benchmarks (23:55)

- Calculating Portfolio Turnover | Implementing a Transaction Cost Model (12:05)

6 reviews for Dakota Wixom – Become a Quantitative Analyst

There are no reviews yet.